What do you want to do?

What is Pension Plan? Meaning, Types & How It Works

Table of Content

After retiring from work, an employee's pension is a great means to collect and provide a set source of income. A pension fund is a savings option that accumulates capital via payroll deductions or employee contributions.

You have saved enough for retirement if you have a pension during your working years. Retirement is a time to catch up with loved ones and do everything on your bucket list. Conversely, being prepared is what really matters. Your pension is the foundation upon which you build your retirement years. To guarantee a good retirement, you should start saving for the pension. The government of India has several pension plans that you can pick from including EPS, NPS and Atal Pension Yojana, Pradhan Mantri Vaya Vandana Yojana (PMVVY), Indira Gandhi National Old Age Pension Scheme (IGNOAPS) and others.

The magnitude of your pension, the principal source of income after retirement, is directly proportional to the amount of money you saved up before retirement. So, this article will cover everything you need to learn about what pension plan is, define pension, and much more. Keep reading.

What is Pension?

So, what does pension meaning imply? After retirement, an employee may have a reliable source of income thanks to their pension. The employer and the worker contribute to a pension fund throughout a worker's working years. Defined benefit plans provide a certain sum for retirees. When people retire from their occupations, they should be able to keep living well because of various pension schemes and learning well about what is pension.

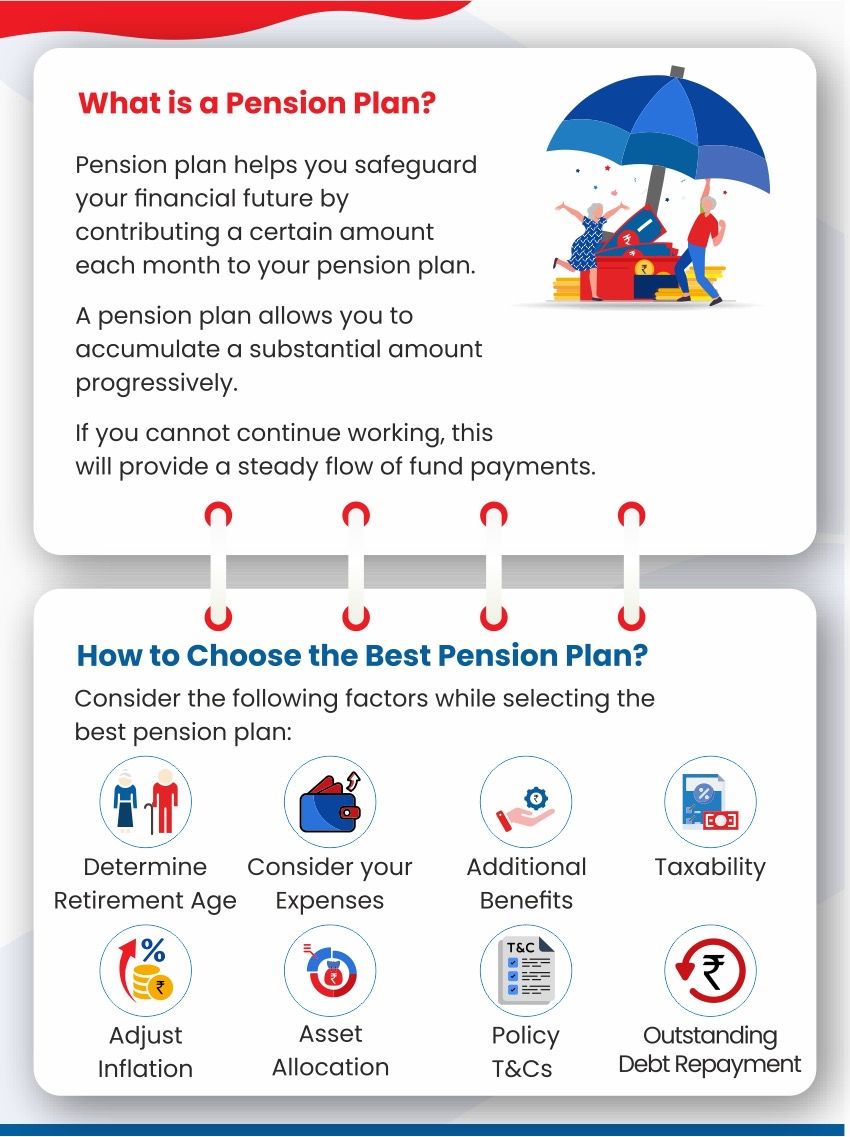

What is a Pension Plan?

So, what is pension plan? You can safeguard your financial future by contributing to a pension or retirement plan. Contributing a certain amount each month to your pension plan allows you to accumulate a substantial amount progressively. If you cannot continue working, this will provide a steady flow of fund payments.

The Public Provident Fund is one of India's best retirement savings schemes. The earlier you start saving for retirement, the more secure your financial situation will be in your golden years. A well-planned retirement account may allow you to beat inflation and secure your post-retirement life, thanks to the power of compounding.

How Does a Pension Plan Work?

After learning about what is pension plan, now let’s see how pension plan works. Employers set up pension schemes and put money into them for their employees. Payroll deductions are often based on variables, including employee income, tenure, and pension plan type.

Employers may provide or demand that workers contribute a portion of their paychecks to a pension fund. Their retirement savings can be even more boosted if they are combined with workplace contributions.

Pension payments are often invested in various assets, such as equities, bonds, mutual funds, etc. The goal is for the funds to earn interest that may be used to fund retirement benefits.

During the accumulation period until retirement, the pension fund's assets are built up by contributions and investment returns. With a pension account, employees may put money away even while they work and can calculate retirement amounts later.

Retired workers may start receiving their pension payments from the scheme. Regular payments, all at once or at certain intervals during retirement, are the norm for distributing these benefits.

Types of Pension Plans

With the help of a pension plan or scheme, you can focus on yourself after retirement. Having a reliable source of income allows you to quit worrying about money and focus on doing the things that bring you joy. There are several types of pension funds that may help you in planning for retirement.

Annuity Plan

One kind of pension plan is the annuity plan, which lets members contribute a certain amount each month until they retire and then get a steady stream of payments (annuities) for the rest of their lives.Social Security Schemes

Pension schemes run by the government, such as Social Security, allow qualified individuals to receive payments after retirement age. These programs get funding from the government, companies, and employees.Deferred Annuity

Deferred annuity plans allow participants to put money down while they're still working, but the payments won't begin until a later date, often when they retire. A sum of money may be set aside for later use.Immediate Annuity

Payments may be sent immediately or at regular intervals to the account of an individual who invests in an instant annuity plan. After you retire, you'll have a reliable source of income, thanks to it.Annuity Certain

An annuity's payout period is fixed and does not change regardless of the annuitant's life expectancy. The annuitant's beneficiary may take over payment distributions if the annuitant does not survive the term.Pension Plan with Life Cover

Life insurance and retirement savings are both included in this pension plan. In the case of the owner's premature death, whether during or after retirement, it serves as both a source of income for retirement and a death benefit.Life Annuity

A life annuity guarantees the annuitant a fixed sum to be paid out every month or year for the rest of their lives. When an annuitant passes away, payments will cease unless a joint-life or guaranteed period option is selected.Guaranteed Period Annuity

The lifelong payments of a guaranteed period annuitant are continued by a beneficiary for the remaining term of the annuitant's death, which is often 10 or 20 years.

Options to Build Corpus for Your Retirement With a Pension Plan

You may save for retirement in many different ways, each with its own set of benefits. Here are a few common options:

National Pensions System (NPS)

One way to ensure a steady income stream in retirement is to enrol in the government-backed National Pension Scheme (NPS). People who work for someone else or are self-employed can save for retirement regularly while they work.

Stocks, bonds issued by foreign governments, and corporate bonds are just a few of the many investment options available to members of the National Pension System (NPS), which allows them to diversify their portfolios and potentially earn higher returns than with more traditional savings vehicles. People may withdraw a portion of their corpus when they reach retirement age, or they can put the remaining amount into an annuity and get a monthly pension payment.Public Provident Fund (PPF)

The primary objective of the Public Provident Fund (PPF), an extended savings scheme offered by the Indian government, is to provide benefits upon retirement. A PPF account may be opened at any of the participating banks or post offices by anyone who wants to contribute to an interest fund that is compounded annually at a fixed retirement fund rate.

You may save money on taxes on your contributions, interest, and withdrawals with PPF, making it a tempting alternative to traditional retirement savings plans. People can extend the maturity term of their PPF accounts by 5-year increments, up to a maximum of 15 years.Unit Insurance Plan (ULIP)

The Unit Linked Insurance Plan (ULIP) mixes investment and insurance components into a single policy. The policyholder can invest the remaining portion of their payment in equity, debt, or a combination of the two, while a portion of the premium goes toward life insurance with ULIPs.

With their ties to the market, ULIPs may outperform more traditional insurance plans regarding return on investment. Individuals may create a nest egg for retirement and enjoy life insurance benefits by investing in ULIPs over the long haul.Employee's Provident Fund (EPF)

The Employee Provident Fund (EPF) is an essential retirement savings option for salaried employees in India. Employers contribute to the Employees' Provident Fund (EPF), which receives a matching contribution from workers and increases at a government-set pace.

Contributions to the EPF accumulate throughout a person's working years, providing a substantial nest egg at retirement. Retirement, a down payment on a home, or medical expenditures are among the permitted uses for withdrawals from an employee's EPF account, which are subject to certain criteria.Pension Funds

Pension funds are investment options overseen by experts that take contributions from people and invest them in various financial assets in the hopes of earning returns.

With these ETFs, investors may be able to save more for retirement. Pension funds provide a wide range of investment options to meet their objective of maximum returns with little risk. One way people might save for retirement is through pension schemes offered by employers or personal retirement accounts.

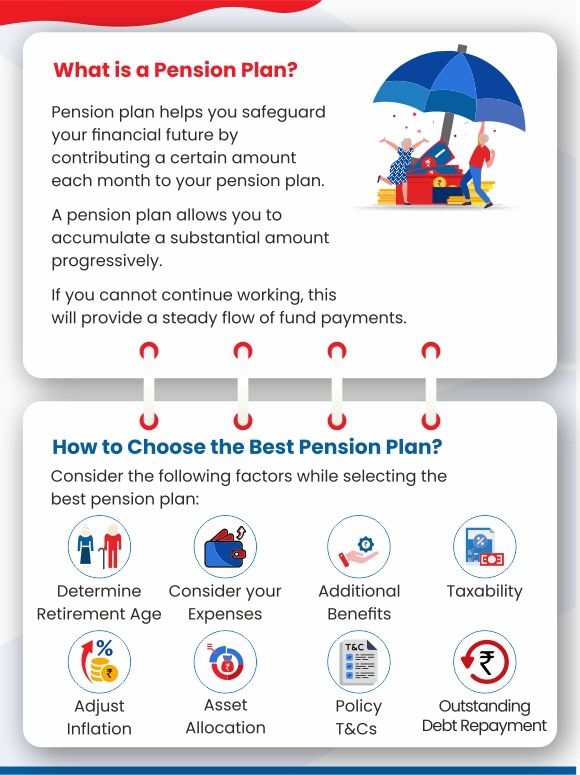

How to Choose the Best Pension Plan?

Your present financial situation and retirement goals should be among the many factors considered when selecting a pension plan. Here are a few key points to keep in mind:

Maximum Retirement Age

Determine the date you intend to retire. This impacts both the time you have to let your assets develop and the duration of your investment horizon. If you start early, You may invest boldly and perhaps make more money.Consider Your Expenses

Set aside monthly money to cover all your expected retirement expenses, such as rent or mortgage, groceries, transportation, healthcare, and entertainment. You may expect to cover these costs in retirement from the money you get from your pension plan.Inflation

When estimating future expenses, inflation should be factored in. Select a pension plan with returns that outpace inflation if you want your purchasing power to remain stable over time. It is wise to consider plans whose investment options have historically beaten inflation.Asset Allocation

Assess the method used to distribute assets by the pension plan. Consider your investing horizon and comfort level with risk before settling on a balanced fund, stocks, or bonds. A diversified portfolio may help you maximise rewards while reducing risk.Added Benefits

Look into the additional advantages of the pension plan, such as critical sickness, disability, and life insurance. With these benefits, you and your family might be financially secure in an emergency.Taxability

Find out what your tax options are in relation to the pension plan. You can get a tax break on your contributions & at the time of vesting/maturity.. Evaluate your options for tax-deferred or tax-exempt investments to maximise your retirement savings while minimising tax liability.Policy Features

Consider the components of the pension plan, including the ease of withdrawals, the plan's portability, and the contribution flexibility. Before making a decision, take stock of your requirements, desires, and financial situation. You can get out of certain plans partially in case of an emergency or other qualifying life event.Policy Fees

Think about all the costs and fees associated with the pension plan, including administration, surrender, and management fees. Charges that are too high could have a devastating effect on your profits in the long run. Look for a plan with transparent and affordable pricing.Outstanding Debt Repayment

Plan ahead for how you will pay off any lingering debts after you retire. Choose a pension plan that won't put your retirement savings at risk if you take out a loan, and include it in your promises to repay loans when you figure out how much money you'll need for retirement.

Are Pension Plans Taxable?

- Any payment received in commutation of pension as a lump sum on maturity is exempt under section 10(10A) of the Income-tax Act, 1961, subject to fulfilment of various conditions under the current income-tax law.

- Regular Pension (Uncommuted Pension) from Pension/Annuity plans would be taxable under the head “Income from Other Sources’.

- Premiums paid in a financial year towards pension/annuity plan for receiving pension from a fund are eligible for deduction under Section 80CCC# up to the limit of Rs. 1,50,000/- in a financial year.

Who is Eligible for Pension?

Eligibility for a pension depends on the country's laws and regulations and the particular pension plan. Pension plans are a common component of employee benefits packages offered by employers. Eligibility for these pension plans is often determined by factors including age, length of employment, and job status (full-time vs. part-time).

Government agencies often provide pension plans to their employees. Members of the armed forces may be eligible for pensions via a variety of retirement plans. Eligibility is determined by years of service and other criteria specific to each military branch.

Tips on Planning for Retirement With a Pension Plan

It is important to plan ahead to have sufficient funds in your retirement years, regardless of whether you rely on a pension. Here are some guidelines to follow so that you may maximise your pension benefits when you retire:

Acquaint Yourself with Your Retirement Plan

From the prerequisites to the contribution amounts and vesting periods and everything in between, make sure you have a firm handle on your pension plan. With this information in hand, you can make a more informed decision regarding your retirement plans.Approach to Inflation

You should factor in inflation as you save for retirement so your pension doesn't become worthless. They are assets to consider if you want to extend the life of your retirement funds and purchase additional stocks or real estate, which may grow in value more quickly than inflation.Make Sure You Review and Adjust Your Approach

At regular intervals, you should review your retirement plan and make any required adjustments to account for changes in your financial situation, lifestyle goals, or economic conditions. Be on the lookout for any changes to your pension plan or laws that affect your retirement savings at all times.

FAQs:

1. What do you mean by pension plan?

Many employers and groups provide pension plans to ensure that retirees have a certain amount of money after they stop working.

2. Do I need a pension plan if I have a PF?

While a Provident Fund (PF) is an option for retirement savings, you could be better off financially in the long run with a separate pension plan that offers even more money and benefits.

3. What is a pension in salary?

A pension in pay allows workers to save a portion of their wage each pay period to have access to benefits when they retire.

4. How is a pension plan different from a term plan?

Pension plans are designed to provide income in retirement, whereas term plans pay out a one-time lump sum payment to beneficiaries in the event of the policyholder's death while the policy is valid.

5. Why is pension important?

Pensions are vital because they relieve a great deal of financial stress in retirement by providing a steady income stream to cover basic expenses and keep people's standard of living at a certain level after they stop working.

Conclusion

You should start putting money into your pension plan, whatever sort it is, as soon as possible. With regular income contributions and prudent fund management, a pension plan may help you secure a comfortable post-retirement. Another way this may happen is if your defined benefit plan receives funding from your company.

Related Article:

- How to Choose a Pension Plan for Retirement Planning

- Things to know about pension plans

- Key Features of Pension Plans You Must Know

- Tax Benefits of Various Pension Plans

Not sure which insurance to buy?

Talk to an

Advisor right away

Advisor right away

We help you to choose best insurance plan based on your needs

Here's all you should know about Retirement Plans.

We help you to make informed insurance decisions for a lifetime.

HDFC Life

Reviewed by Life Insurance Experts

HDFC LIFE IS A TRUSTED LIFE INSURANCE PARTNER

We at HDFC Life are committed to offer innovative products and services that enable individuals live a ‘Life of Pride’. For over two decades we have been providing life insurance plans - protection, pension, savings, investment, annuity and health.

Unit Linked Life Insurance products are different from the traditional insurance products and are subject to the risk factors. The premium paid in Unit Linked Life Insurance policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the insured is responsible for his/her decisions. The name of the company, name of the brand and name of the contract does not in any way indicate the quality of the contract, its future prospects or returns. Please know the associated risks and the applicable charges, from your insurance agent or the intermediary or policy document of the insurer.

#Tax benefits & exemptions are subject to conditions of the Income Tax Act, 1961 and its provisions.

#Tax Laws are subject to change from time to time.

#Customer is requested to seek tax advice from his Chartered Accountant or personal tax advisor with respect to his personal tax liabilities under the Income-tax law.

@. Amount of guaranteed income will depend upon premiums paid subject to applicable terms and conditions.

@@. As per Income Tax Act, 1961. Tax benefits are subject to changes in tax laws.

ARN – ED/02/24/9375